In StartupBlink’s Global Startup Ecosystem Index 2023, we have identified 11 industries. In this article, we will delve into the insights derived from an extensive sample of startups showcased on our global startup ecosystem map. By examining data from 2022 to 2023, you can gain valuable knowledge about the most popular industries and the distribution of unicorns within them. Analysis at a granular level of all Industries, by country and city, is available for StartupBlink PRO users.

Industry Analysis

In this industry analysis, we analyzed the 11 industries based on the number of startups in our database.

Software & Data Continues to be the Dominant Industry with over 30%

Once again, the Software & Data industry maintains its position as the leading industry for startups in 2023, with a staggering 31.95% of all startups operating within this sector. This finding reaffirms the pervasive influence of technology-driven solutions and the growing demand for data-driven applications across various domains. Startups in this industry are capitalizing on advancements in software development, artificial intelligence, and big data analytics to create innovative solutions that address a wide range of challenges. DuckDuckGo, Medium and ResearchGate are notable startups from these industries based on our database.

Healthtech and Fintech: Promising Sectors for Innovation

Healthtech and Fintech continue to capture significant attention from entrepreneurs and investors alike. With 12.74% and 10.19% of startups operating in these sectors, respectively, it is evident that both industries hold immense potential for disruptive innovation. The Healthtech sector, in particular, is witnessing a surge in startups developing cutting-edge technologies to revolutionize healthcare delivery, patient care, and medical diagnostics. On the other hand, the Fintech sector is driving innovation in financial services, with startups leveraging technology to provide seamless digital banking, payment solutions, and blockchain applications. Halodoc, Practo, QIWI and Pocket Teller are notable startups from these industries based on our interactive map.

Decline in Ecommerce & Retail and Social & Leisure

While still popular choices for entrepreneurs, the Ecommerce & Retail and Social & Leisure industries have experienced a slight decrease in startup percentages compared to the previous year. Ecommerce & Retail now accounts for 9.47% of startups, down from 9.76% in 2022, while the Social & Leisure industry has seen its startup percentage decrease from 10.38% to 9.74%. These shifts suggest that entrepreneurs are exploring new sectors and diversifying their focus beyond retail and leisure-based ventures, seeking opportunities in emerging industries. Tokopedia, Pharmeasy, Juul and Foursquare are notable startups from these industries based on StartupBlink’s Global Startup Ecosystem Map.

Analysis at a granular level of all Industries, by subindustries is available for StartupBlink PRO users.

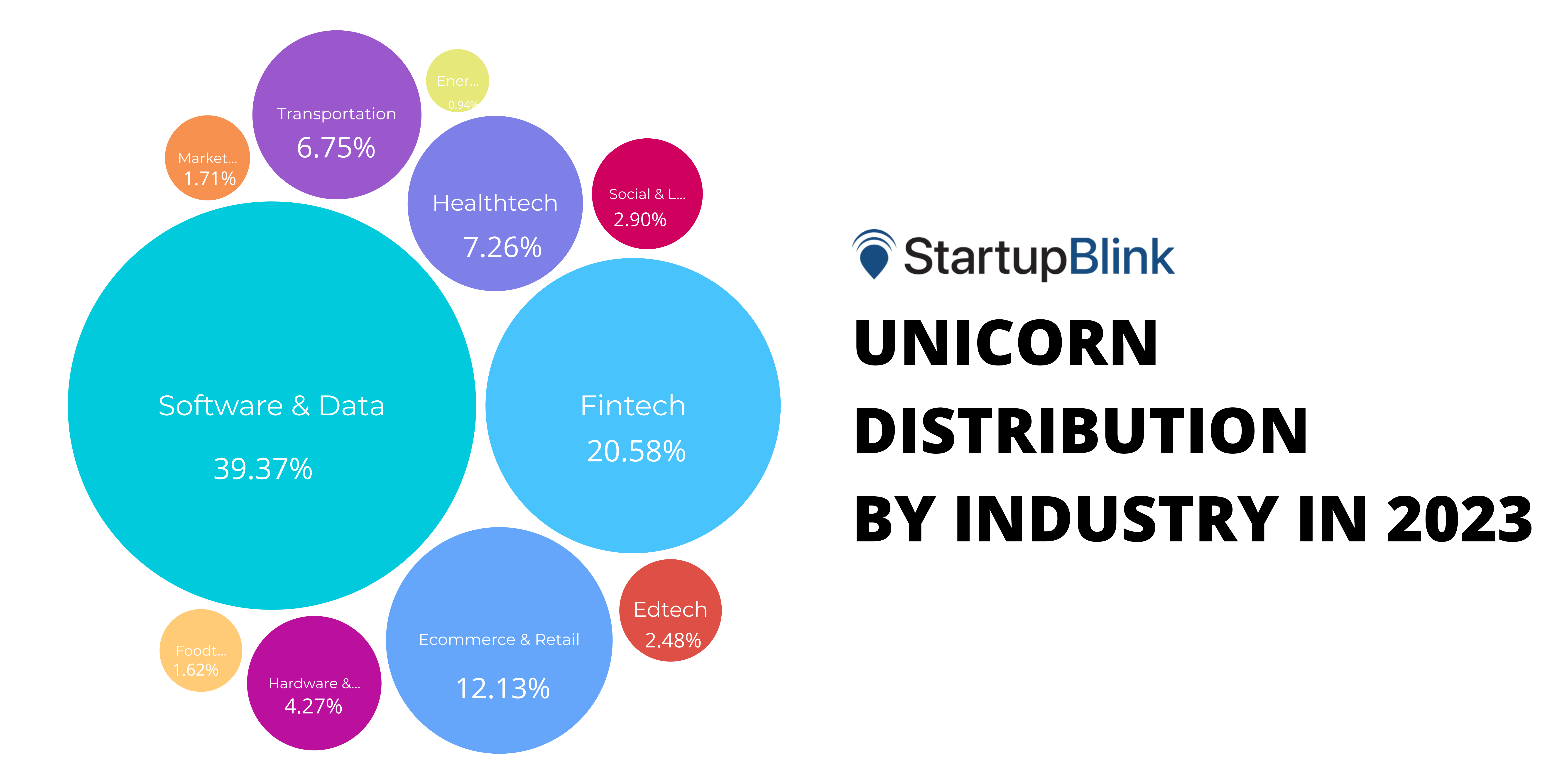

Unicorn Distribution by Industry

Unicorns, the startups valued at over $1 billion, serve as beacons of success and scalability within specific industries. By examining the distribution of unicorns, you can identify sectors that are attracting significant attention and funding.

Once again, Software & Data is the industry with the most unicorns

Once again, the Software & Data industry proves to be the undisputed leader in producing unicorns, with a substantial 39.37% of all unicorns originating from this sector. This statistic highlights the industry’s exceptional ability to foster innovation and generate high-value startups. With 461 unicorns, the Software & Data industry continues to set the standard for groundbreaking solutions and disruptive technologies across various domains. Some notable Software & Data unicorns from our database include OpenAI, Discord, and Canva.

Together with Fintech startups, they had the more than 50% of all the unicorns on our database. Fintech is punching above its weight, despite having 10.43% of our sampled startups, it has produced the 20% of all unicorns. Some notable Fintech startups include Stripe, Klarna and Revolut. These unicorns are reshaping banking, payments, and other financial services on a global scale.

Despite its smaller share in startup count, E-commerce & Retail is the third industry with the most Unicorns

The E-commerce & Retail industry secures a significant portion of the unicorn count, as it captures 12.13%, and it is the third largest industry producing unicorns. This shows the ability of startups in this industry to reach higher valuations, although they are lower in quantity. Some of the notable E-Commerce & Retail unicorns from our database include Meesho, Doctolib and Xiaohongsu.

Healthtech could not sustain its share of 10% when it comes to producing unicorns

Healhtech is the second industry with the most startups, however this trend does not expand to unicorn count, as it only has the 7.26% of unicorns, showing that Healhtech startups struggle when it comes to raising massive investment.

Transportation is punching above its weight!

While the Transportation industry has a share of 2.71% for the total number of startups, it captured the 6.75% of the unicorn count chart, proving that Transportation startups are highly successful at scaling, regardless of the smaller size of the industry. Some notable Transportation unicorns include SpaceX, Swiggy and Bolt.

Like Healhtech and Transportation, Hardware & IoT, Social & Leisure, Edtech, Marketing & Sales, Foodtech and Energy & Environment’s share in the unicorn count chart is below 10%. However, this correlates with their lower share in terms of startup count as well.

Industry Rankings Methodology

Aside from the general rankings, 11 industry rankings are calculated by StartupBlink, along with 91 sub industries. Our full industry rankings are available online for StartupBlink PRO users. The Methodology used for these rankings is identical to the algorithm of the global rankings, but for parameters that are influenced by industry information, such as startups, funding, and unicorns, we only consider the relevant data.

Download the Global Startup Ecosystem Index to discover the current state of the Global Startup Ecosystem

About Us:

StartupBlink is the world’s most comprehensive startup ecosystem map and research center, working with over 100 government entities worldwide. StartupBlink’s global startup ecosystem map has tens of thousands of registered startups, coworking spaces, and accelerators, creating a robust sample of innovation globally.

Our Partners: